Trading is a method of making money that allows you to flexibly work at home, and make decisions based on political and news outlook. Currency trading is the number one market in the world and people from all over trade every single day and make a profit.

Whether you are looking to trade classic flat currency or join the Bitcoin Era, it is important to be smart with your trades and learn how to manipulate the market to your needs. Today we are looking at some of the trading strategies that you can use either alone or in combination to make the most of your trades.

Fundamental Analysis

The first type of trading strategy is fundamental analysis. This is one of the most popular methods for trading and it is used by most traders in some capacity.

The idea behind fundamental analysis is to use the country’s economic data to predict trends and make trades. It uses data from many different sources such as:

- Economic conditions

- Future profit outlook

- Company analysis

- Industry analysis

All of these factors make an impact on the economy and therefore make an impact on the way people will interact with different currencies. Using multiple sources of information allows traders to make an educated guess at the trend of the market as a whole, and specifically, certain currencies.

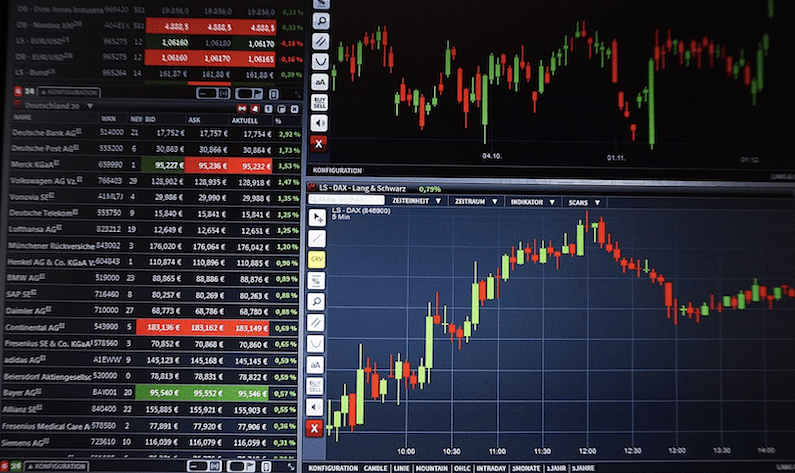

Technical Analysis

Technical analysis is another popular strategy which is preferred by some traders. The idea behind technical analysis is to use past data and trends in order to see what will happen in the market in the present. For example, if a certain level of Interest Rate affected a currency in a certain way once, chances are it will do the same thing again this time.

Trend Trading

Trend trading uses current trends to make trades. For example, if the trend is heading in a downward motion, marked by blue lines. If you see a trend like this, chances are it will continue in the same direction and you can safely bet on a sell. This, of course, can change with a sudden decision, however, it provides a helpful indicator for us to use.

Momentum Trading

Momentum trading is a strategy which uses swift U-Turns in a trend in order to make a trade. For example, we can sometimes observe swift change which sends the value of a said currency in a downward spiral. Whenever you see a stable value and a sudden change like this, it is a good idea to open a trade as people will flood the market and swing the trade in one direction or another like osmosis.

Swing Trading

Swing Trading is a simple strategy for new traders to follow as it allows us to use sharp changes in a market trend to make a trade which brings a decent profit. For example, there may be a time when the value of the currency rises, swings down and then swings back up again. You will often see a point during the market where people suddenly change their position and this is often due to indicators such as the Average True Range or Relative Strength Index.